How To Get Copy Of Bankruptcy Discharge Papers Can Be Fun For Everyone

101(10A). An involuntary chapter 7 instance might be begun under particular scenarios by a petition submitted by lenders holding claims versus the borrower.

For objectives of this magazine, recommendations to U.S. trustees are also appropriate to insolvency managers. A fee is charged for transforming, on demand of the debtor, a situation under phase 7 to a case under phase 11.

There is no fee for transforming from phase 7 to chapter 13. Unsecured financial obligations typically might be specified as those for which the extension of debt was based simply upon an assessment by the creditor of the borrower's capability to pay, as opposed to protected financial debts, for which the expansion of credit rating was based upon the lender's right to seize security on default, in addition to the debtor's ability to pay.

The deals for financial items you see on our platform originated from companies that pay us. The cash we make assists us give you access to complimentary credit report as well as records and also assists us develop our various other wonderful devices and educational products. Payment might factor right into exactly how and where items show up on our system (and also in what order).

The Obtaining Copy Of Bankruptcy Discharge Papers Ideas

That's why we provide functions like your Approval Probabilities as well as cost savings quotes. Certainly, the offers on our platform do not stand for all economic items around, but our objective is to show you as lots of fantastic options as we can. The primary step in establishing whether a bankruptcy is appropriate for you is specifying what it is.

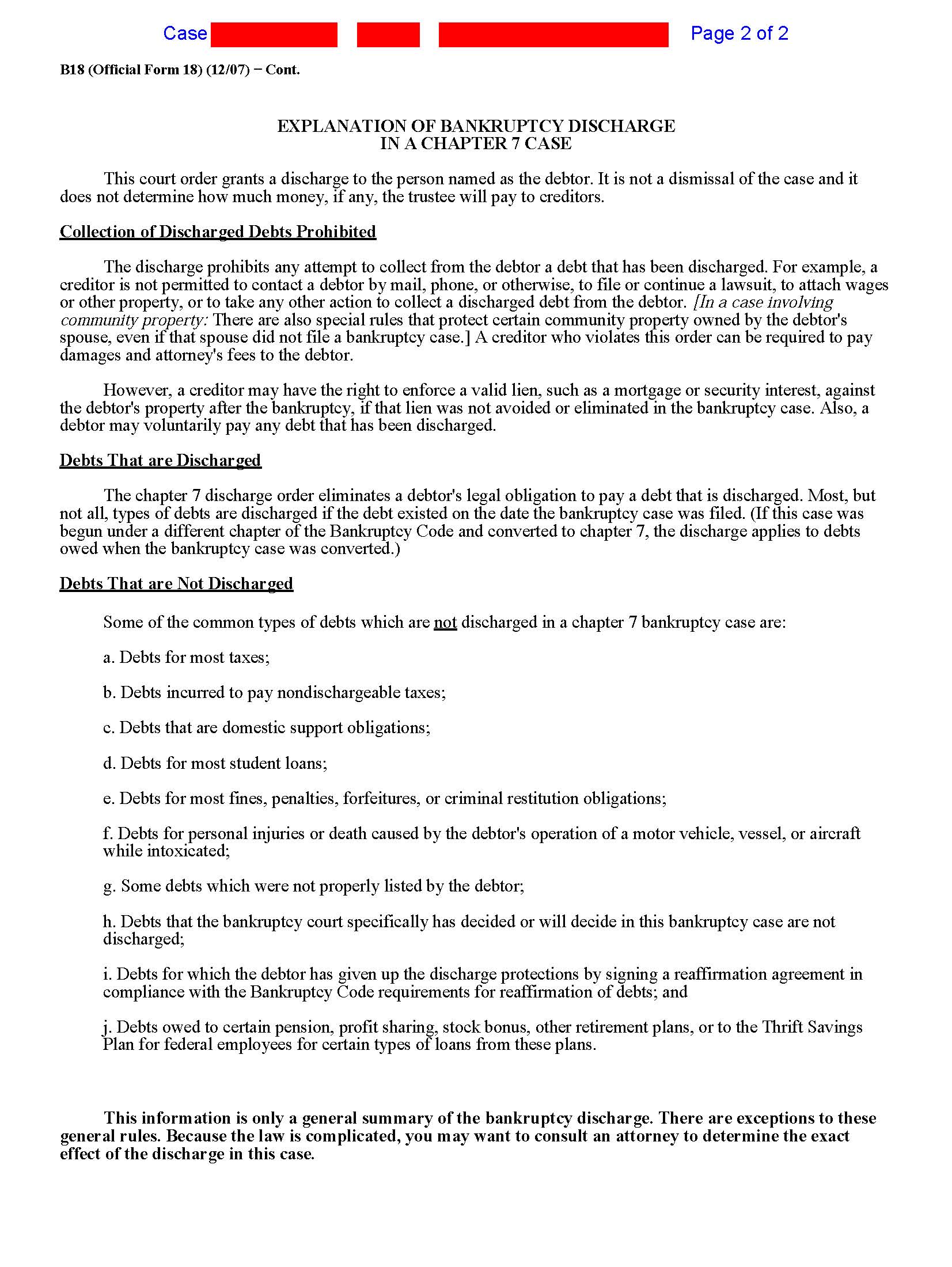

Discharge is the lawful term definition you're not legally called for to pay the debt, and collectors can not take any type of more action to accumulate it. Complying with an insolvency discharge, financial debt enthusiasts as well as lending institutions can no much longer attempt to accumulate the discharged financial debts. That implies say goodbye to calls from enthusiasts and also no even more letters in the mail, as you are no more personally accountable for the debt.

With a protected financial debt, the car loan is connected to an asset, or security, that lending institutions can confiscate if you stop paying. https://b4nkruptcydc.livejournal.com/profile. Unsafe debt is not backed by security, so loan providers do not have the same recourse (bankruptcy discharge paperwork). If you really feel the crushing weight of credit score card debt as well as an auto loan on your shoulders, a personal bankruptcy might be a practical option assuming you recognize the repercussions.

When you tidy your economic slate with an insolvency, you'll need to manage some credit-related repercussions. A personal bankruptcy will certainly remain on your credit scores records for as much as either seven or one decade from the date you submit, relying on the sort of insolvency. Considering that your credit rating are computed based upon the info in your debt records, an insolvency will affect your credit rating also.

The How Do You Get A Copy Of Your Bankruptcy Discharge Papers PDFs

To learn more, inspect out our article on what happens to your credit history when you apply for personal bankruptcy. A discharged Chapter 7 insolvency as well as a discharged Phase 13 personal bankruptcy have the very same influence on your credit report, though it's feasible a loan provider may look more favorably on one or the various other.

Removing financial debt collection agencies is a wonderful advantage, however you might spend the bulk of one decade fixing your credit rating. A bankruptcy discharge might be the ideal means for you to leave financial obligation. Take into consideration other courses to financial debt liberty and also financial security, such as a debt settlement or a financial debt settlement plan, prior to determining on insolvency as the most effective way onward.

He has an MBA in finance from the College of Denver. When he's away from the keyboard, Eric enjoys checking out the globe, flying tiny Learn more (https://padlet.com/bankruptcydischargepapers7424/9vlf45034qt7le3a)..

Discover much more regarding financial obligations discharged at the end of Chapter 13 insolvency. Noand lots of find this reality unusual. As opposed to detailing the wiped-out financial obligations, the order will give general details regarding financial debt classifications that do not disappear in insolvency or "nondischargeable financial debt." For example, it will certainly discuss that you'll likely remain in charge of paying: domestic assistance commitments (spousal or child support) most trainee lendings and also tax financial debt accounts that the court decides you can not release most fines, fines, and criminal restitution some debts that you failed to detail properly certain car loans owed to a retired life plan money owed as an outcome of harming someone while operating a lorry while intoxicated, and also responsibilities covered by a reaffirmation agreement (a court-approved arrangement to try this proceed paying a lender).

A Biased View of How Do You Get A Copy Of Your Bankruptcy Discharge Papers

Responsibilities emerging from fraud devoted by the debtor or individual injury triggered by the borrower while intoxicated are financial debts that the court may proclaim nondischargeable. Although a discharge relieves you of your responsibility to pay a debt, it won't remove a lien that a financial institution may carry your residential or commercial property (https://href.li/?https://copyofbankruptcydischargepapers.com/).

Some liens can be removed, however, even after the closure of the personal bankruptcy situation. After the court releases the discharge, creditors holding nondischargeable debts can proceed collection initiatives.

The information permits the creditor to validate the insolvency which the discharged debt is no much longer collectible. You'll find the filing date and also case number at the top of nearly any file you obtain from the court. The discharge day will certainly appear on the left-hand side of the discharge order quickly alongside the releasing court's name (you'll discover the instance number in the top box).